Since this year, international geopolitical conflicts and domestic epidemic epidemics and other over-expected factors intertwined, China's textile industry is facing a more complex and severe development environment. Affected by the epidemic, April

Since May, as the situation of domestic epidemic prevention and control gradually stabilized, production and logistics accelerated to return to normal, and the resumption of business and market was steady.

Restore normal, the restoration of business and market steadily, in the country a series of "stable growth" policy measures to support the main operating indicators of the textile industry to achieve pressure to rebound, showing a strong development of resilience

The strong development resilience and risk resistance. Looking ahead to the whole year, the textile industry is facing a complex development situation, the textile enterprises production and operation pressure is more prominent, the industry to achieve a stable operation of the year is still facing a test

The industry is still facing tests to achieve stable operation throughout the year.

Since the second quarter, the rebound of the domestic epidemic, the international political and economic environment is more complex and other factors, the textile industry has been facing local phased shutdown, poor logistics operation, the

Raw material prices rose to a high level and other risk challenges, production and operation fluctuations. Against the background of weakening domestic and external market demand, the industry's prosperity entered a contraction range, but with the epidemic prevention and control

But as the situation of epidemic prevention and control gradually stabilized, enterprise production and sales gradually recovered, the industry's comprehensive prosperity than the first quarter slightly rebounded. According to the China Textile Industry Federation survey, the second quarter of 2022, the textile industry boom index

46.3, up 3.7 percentage points from the first quarter of this year.

Capacity utilization rate of the textile industry has declined, and production growth slowed down. According to the National Bureau of Statistics data, the first half of the year, the textile industry, chemical fiber industry capacity utilization rate of 78% and 84%, respectively, compared with the same period last year

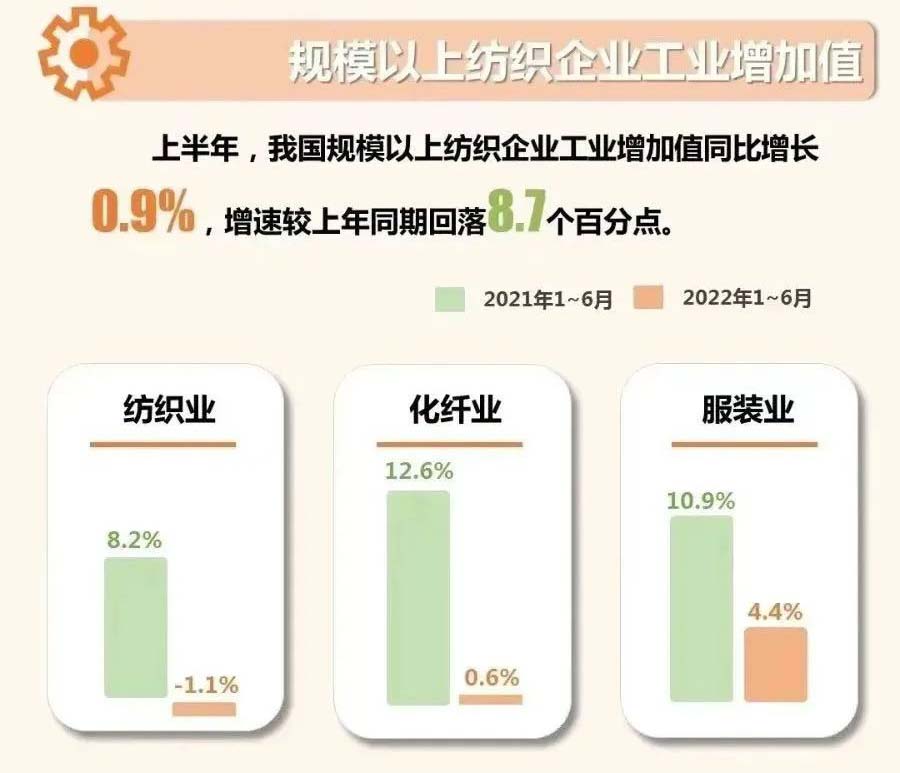

The same period last year, respectively, fell 1.7 and 2.1 percentage points, but still higher than the national industrial capacity utilization level of 75.4% during the same period. In the first half of the year, the industrial value added of enterprises above the size of the textile industry increased by 0.9% year-on-year

In the first half of the year, the industrial added value of enterprises above the scale of the textile industry increased by 0.9% year-on-year, with the growth rate slowing down by 8.7 and 4 percentage points compared with the same period of the previous year and the first quarter of this year respectively; most of the links in the industry chain achieved positive growth in production, chemical fiber industry and garment industry industrial added value increased by 0.6% and 4.4% respectively.

The added value of the chemical fiber and garment industries increased by 0.6% and 4.4%, respectively.

Domestic market gradually recovered, and exports achieved stable growth

Since May, with the domestic epidemic has been effectively controlled, the national "consumption promotion" has been a major factor in the recovery of the domestic market.

Since May, with the domestic epidemic has been effectively controlled, the national "promote consumption" policy has been effective, domestic consumption gradually recovered. According to the data from the National Bureau of Statistics, the retail sales of clothing, footwear and textiles in the first half of the year decreased by 6.5% year-on-year.

According to the National Bureau of Statistics, the retail sales of apparel, footwear, headgear, needlework and textiles decreased by 6.5% year-on-year in the first half of the year, but the rate of decline narrowed by 1.6 percentage points compared with January-May this year. Network retail channel growth is relatively stable, the first half of the national online retail sales of wearing goods rose 2.4% year-on-year, compared with

The first quarter of this year rose by 1.5 percentage points, reversing the negative growth trend since April.

China's textile and apparel exports in general to achieve stable growth. China Customs data show that China's textile and apparel exports in the first half of the total amounted to $ 156.49 billion, up 11.7% year-on-year, in the export

Supported by the price increase, the export amount hit the highest level in the same period of the previous year. Among the export products, textile exports amounted to $ 76.32 billion, an increase of 11.3% year-on-year; clothing exports amounted to

80.17 billion U.S. dollars, an increase of 12 percent. Export markets, Southeast Asia and other countries in the textile supply chain this year to basically resume normal operation, driving China to its yarn, fabric and other industry chain supporting

Product exports to ASEAN in the first half of the year, China's total exports of textiles and apparel 27.71 billion U.S. dollars, an increase of 23.3%, of which yarn and fabric exports growth rate reached 29.9% and

24.6%; China's exports to the Regional Comprehensive Economic Partnership Agreement (RCEP) member countries amounted to $45.57 billion, an increase of 13.7% year-on-year, indicating that the implementation of RCEP is conducive to the export environment

The export volume to RCEP member countries reached US$45.57 billion, up 13.7% year-on-year, indicating that the implementation of RCEP is conducive to a stable and positive export environment.

Enterprise efficiency continues to be under pressure, the investment situation is basically stable

Enterprise efficiency continues to be under pressure, the investment situation is basically stableBy the high price fluctuations of raw materials and demand-side market dynamics of the double squeeze, the economic benefits of textile enterprises continue to be under pressure since this year. According to the National Bureau of Statistics data, the first half of the country

36,000 textile enterprises above the size of the business income rose 5.7% year-on-year, the vast majority of the industrial chain to achieve positive growth in business income, including chemical fiber, printing and dyeing, filament weaving and other industries business

Revenue growth rate reached more than 10%. In the high cost, weak demand situation, the total profit of textile enterprises above the scale decreased by 17% year-on-year, including cotton, chemical fiber and other upstream industry profit scale has

The total profit of cotton, chemical fiber and other upstream industries have shrunk, dyeing, knitting, clothing, home textiles, filament weaving and other industries still achieve positive growth.

In the complex development situation, textile enterprises adhere to the in-depth promotion of transformation and upgrading, in the intelligent, green technology transformation and upgrading, as well as regional layout adjustment and other areas of effective investment to achieve steady growth.

Growth. According to the National Bureau of Statistics data, in the first half of China's textile industry, chemical fiber industry and garment industry fixed asset investment completed year-on-year growth of 11.9%, 31.9% and 33.8%, of which the textile industry investment growth rate is slower than the same period last year.

The growth rate of investment in the textile industry slowed down by 3.3 percentage points compared with the same period of the previous year, while the growth rate of investment in the chemical fiber and garment industries accelerated by 15.3 and 28 percentage points respectively compared with the same period of the previous year.

In the first half of the year, the textile industry to overcome the impact of various factors beyond expectations, efforts to enhance the development of resilience and resilience to risk, the main economic indicators of operation, although under pressure downward, but showed a gradual improvement.

Signs of improvement. Looking ahead to the whole year, the textile industry economic operation pressure is still greater, but still has the basis for recovery to improve. Domestic epidemic prevention and control situation is generally under control, the country a series of solid stabilization of the economy

Economic policies continue to show results, China's macro economy is expected to further stabilize and rebound, for the domestic market to improve the rebound, production and demand cycle to maintain a solid foundation. Backbone enterprises in technological innovation

New, business innovation, supply chain renewal and other areas of exploration will help stimulate the industry's operational vitality and consumer market potential, for the stable recovery of the textile industry to provide long-term support. At the same time, China

Textile industry complete, advanced manufacturing system advantage is still outstanding, in the complex development situation for the stable release of market competitiveness still has an important positive role.

At the same time, we must also see that the current instability and uncertainty is still more, the textile industry to maintain stable operation throughout the year there are still many difficulties, the industry still needs to consolidate the foundation of a stable economic recovery. International

International economic recovery while facing geopolitical risks, inflationary pressures, currency liquidity contraction and other complex factors, downward pressure increases, it is difficult to make significant improvements in the short term. In the context of high prices

Against the background of high prices, the actual purchasing power of consumers decreased, high energy consumption crowded out clothing consumption expenditure and other factors have formed a suppressive impact on the international market. Southeast Asia, South Asia and other countries textile supply chain

Accelerated recovery, making China's textile industry is facing international competition tends to be fierce, many factors will increase the pressure on the textile industry to maintain steady growth in exports. The impact of the domestic epidemic has not been completely

Eliminate the impact of the epidemic has not been completely, the consumption scene is limited, income is expected to decline, the lack of consumer confidence and other factors will limit the growth of domestic consumption of clothing goods. In the case of weakening demand, the supply side of the textile industry

Faced with high fluctuations in the price of bulk raw materials, cost pressures along the industrial chain conduction difficulties and other issues, enterprise production and operation pressure is expected to remain relatively prominent.

The textile industry will continue to implement the decisions and plans of the State Council of the Party Central Committee, adhere to the "steady progress" of the general tone of work, steadily releasing years of deep adjustment and transformation of the accumulated development resilience.

Continuously activate the potential for high-quality development, continue to play a good role in the industry to protect production and supply, stimulate domestic demand, improve employment and income and other aspects of the positive role, and strive to consolidate a stable economic recovery.

We will continue to play a positive role in safeguarding production and supply, stimulating domestic demand, improving employment and income, and strive to consolidate the foundation of stable economic recovery, maintain economic operation in a reasonable range, and welcome the 20th Party Congress with practical actions!

With the "normalization" of the epidemic, the United States and Europe and other major consumer markets for textiles and clothing due to supply chain security and cost considerations, restart the decentralization of orders, will have an impact on the export orders of Chinese textile and clothing enterprises.

With the "normalization" of the epidemic, the United States and Europe and other major consumer markets for textiles and clothing due to supply chain security and cost considerations, restart the decentralization of orders, will have an impact on the export orders of Chinese textile and clothing enterprises.

This will have an impact on the export orders of Chinese textile and apparel enterprises. Nearly 40 percent of U.S. companies surveyed plan to adopt a diversification strategy in the next two years, sourcing from more countries and regions or working with more suppliers. This percentage is higher than the 2021

of 17 percent. India, Central American FTA members and Bangladesh are the countries most interested in advancing sourcing diversification strategies for U.S. apparel companies, with more than half of respondents saying they will increase their sourcing from these three regions in the next two years.

More than half of the companies surveyed said they would increase their sourcing from these three regions in the next two years.

In the second half of the year, in the face of many pressures, China's textile and apparel exports also have opportunities for development. A package of domestic policies to stabilize economic growth will gradually come into effect, which will provide the whole industry chain

and export trade to inject more positive energy. In addition, under the influence of the epidemic and inflation, the U.S. and European markets in the second half of the year need more stable supply, quality and good price of consumer goods. Although U.S. and European purchasers will

Although the restart of orders decentralization, but in the short and medium term 'China + Vietnam + other' is still the mainstream mode of U.S. procurement of textile and apparel products.